FX168 (Hong Kong) - OKX, one of nine foreign cryptocurrency exchanges blocked in India, announced Thursday (March 21) that it was terminating its cryptocurrency trading services in India and that clients must withdraw their funds by April 30, after local regulators issued a compliance notice.

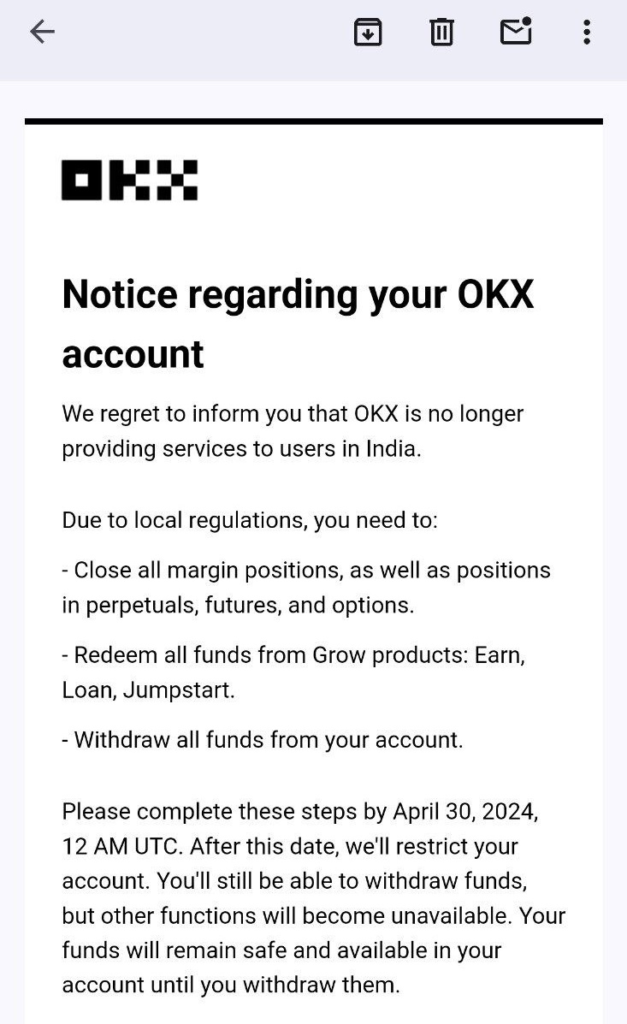

In a notice sent to Indian users on Thursday, Ouyi asked them to close their accounts and redeem their funds by April 30th. The cryptocurrency exchange said local regulatory hurdles were a key reason behind the decision.

(Source: CoinTelegraph)

The Financial Intelligence Agency (FIA) has asked the Department of Electronics and Information Technology (DEIT) to block the websites of the notified cryptocurrency exchanges within two weeks of receiving the notification.

After authorities blocked its website and apps in January, Ouyi implemented a new registration process and conducted rigorous Know Your Customer (KYC) checks.

However, its notification to users indicates that the exchange will no longer operate in India.

Despite being a booming market, India remains a tricky area for foreign cryptocurrency exchanges due to the lack of clear regulatory guidelines and strict government action.

Discussions about a regulatory framework have been ongoing for nearly four years, but the Indian government seems to have no intention of recognizing the emerging cryptocurrency market or placing it under legal oversight.

There is no timeline for when India will be able to enact formal cryptocurrency regulations, but a hefty 301 TP3T tax on cryptocurrency revenues with no provision for offsetting losses and an 11 TP3T tax on deduction at source (TDS) on every cryptocurrency transaction has forced some established players to shift their bases elsewhere.

India's finance minister said in a recent interview that they can't treat cryptocurrencies like fiat currencies, which is why the government has yet to provide a clear regulatory structure.

However, this is the conventional answer of government agencies around the world and has nothing to do with regulating the cryptocurrency market, as market participants are not demanding that cryptocurrencies be treated with the same weight as national fiat currencies, but rather that they be regulated with greater clarity, much like traditional stock markets.

Not only is it facing a blow in India, but Euronext is also taking down USDT trading pairs in Europe.

As the European Union (EU) prepares to adopt a comprehensive regulatory framework for cryptocurrencies, trading pairs in the European Economic Area (EEA) are beginning to emerge, meaning that cryptocurrency exchanges will expand the adoption of euro fiat currencies.

資料來源:https://www.fx168news.com/article/%E5%8D%B0%E5%BA%A6-580337

Disclaimer: The contents of this article are for informational purposes only and should not be construed as any form of promotion, investment advice, or invitation, solicitation or recommendation of any investment product.

The contents of this article have been reprinted.offensiveIf there is anything wrong, please contact us and we will remove it immediately, thank you.

Readers should make their own assessment and seek professional advice.