FX168 (Hong Kong) - Binance, the world's largest crypto exchange, has reached a settlement with the US Department of Justice in 2023, which has led to the resignation of former Chief Executive Officer Zhao Changpeng (CZ). Industry sources have revealed that the investigation has moved on to the next, more rigorous stage. Anonymous industry sources revealed that the DOJ will send investigators inside Money Security to look into records of dealings with U.S. customers.

According to BlockTempo, citing Jinse Finance (deleted), at the beginning of this year, it was confirmed that the U.S. Department of Justice (DOJ) would send personnel to investigate inside CoinSafe, and DOJ investigators have access to various documents of CoinSafe, and judging from the current time, it is very likely that U.S. DOJ investigators have already stationed in CoinSafe's office for a period of time, which can be said to be "one and the same" in terms of the progress of the investigation. It can be said that the U.S. and Coin have become "one and the same" in terms of the current progress of the investigation.

(Source: BlockTempo)

Earlier in the day, the currency media also confirmed the validity of the rumor from sources close to the industry, but closer confirmation is still pending more public information from the U.S. government.

Bloomberg reported that people familiar with the matter said that CoinSecure has asked major brokers to conduct stricter checks to prevent U.S. investors from accessing cryptocurrency exchanges following its guilty plea.

(Source: Bloomberg)

Since around the time of the November 2023 plea, Currency Security has asked major brokers such as FalconX and Hidden Road to request more information from their clients, people familiar with the matter said.

Those checks include questions about office addresses and the locations of employees and founders, and require respondents to sign certificates confirming the accuracy of their answers, two people familiar with the matter said.

In November 2023, Currency Security pleaded guilty to violating U.S. anti-money laundering and sanctions laws and was fined a landmark $4.3 billion. The U.S. Department of Justice said at the time that the global platform targeted U.S. customers, including large and valuable traders that deepen exchange liquidity, while refusing to comply with relevant U.S. legislation.

The U.S. Department of Justice said in a November 21, 2023, statement that Coin Security employees "called U.S. VIPs to encourage them to provide information indicating that the customer was not in the United States."

Against this backdrop, the cryptocurrency industry is wary of compliance-related changes to key trading venues for digital assets. For example, people familiar with the matter previously told Bloomberg that the exchange has tightened requirements for listing new digital tokens.

"CoinSecure is fully committed to compliance and is open about how it evaluates end users who have access to its platform," the company said in a statement in response to a query about whether prime brokers were being asked to undergo more stringent checks. "By making its standards transparent, CoinSecure provides clarity for businesses that want market-leading liquidity."

The exchange mentioned its CoinSecure Link program, which is said to have been launched to provide trading and connectivity services for businesses such as exchanges and brokers, as well as algorithmic or other automated trading platforms.

A section of the MoneySafe website also outlines the platform's methodology for determining whether a corporate entity counts as a U.S. user.

Upon his resignation, Zhao handed over to his successor, Richard Teng, the task of rebuilding the reputation and market share of the Coin Exchange under the close scrutiny of the United States.

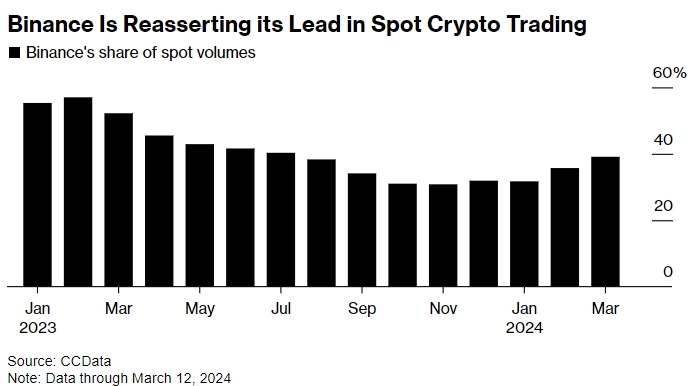

According to CCData, the platform's share of global spot cryptocurrency trading volume slipped from nearly 60% to about 30% last year, but has since recovered to about 40%. The record-breaking surge in the price of Bitcoin over the past 12 months has rekindled speculative fervor and trading activity in the digital asset space.

(Source: Bloomberg)

Before cryptocurrencies made a comeback, the future of the industry was in doubt due to a deep bear market in 2022, exposing a slew of questionable practices that subverted platforms such as Sam Bankman-Fried's (SBF) busted exchange FTX.

As with traditional markets, cryptocurrency prime brokers aim to provide hedge funds and other clients with a one-stop shop for services such as financing, technology and research. Cryptocurrency Prime Broker partners allow investors to access the liquidity provided by the exchange.

Digital asset traders are optimistic about the platform's prospects, judging by the performance of the Coin Exchange's BNB, which has risen about 80% this year, overtaking Bitcoin.

Justin d'Anethan, head of Asian business development at market maker Keyrock, likened CurrencySafe to a large global bank that could pay a fine for a similar mistake and then "tighten up its operations and move on".

"Local investors in cryptocurrencies, and even newcomers, may realize that compliance errors or knowledge of customer misconduct don't really affect the good functioning of the platform itself, nor the solvency and liquidity of the exchange," he said.

資料來源:https://www.fx168news.com/article/%E5%B8%81%E5%AE%89-577259

Disclaimer: The contents of this article are for informational purposes only and should not be construed as any form of promotion, investment advice, or invitation, solicitation or recommendation of any investment product.

The contents of this article have been reprinted.offensiveIf there is anything wrong, please contact us and we will remove it immediately, thank you.

Readers should make their own assessment and seek professional advice.